How to Get Rich: Insights from PDF Books

Unlocking the secrets to wealth accumulation is now more accessible than ever. PDF books offer invaluable insights. Explore expert strategies and financial wisdom that can guide you toward achieving financial freedom and building lasting wealth.

Embark on a journey of financial enlightenment through the power of books. This exploration delves into wealth-building strategies, gleaned from the pages of financial experts and self-made millionaires. Discover how these literary resources can provide actionable inspiration to transform your financial life and elevate your net worth.

Uncover the core lessons that will guide you to wealth, by understanding principles, strategies and habits. Learn to think like the rich, master financial concepts, and implement practical steps for financial success. These books offer invaluable insights into investing, entrepreneurship, and personal finance management.

From timeless classics like “The Richest Man in Babylon” to modern guides like “The Millionaire Fastlane”, these books equip you with the knowledge and mindset necessary to navigate the path to financial independence. Explore how reading can be the key to unlocking your wealth-building potential.

Key Books on Getting Rich

Unlock financial success with these essential reads. Discover insights from timeless classics and modern guides. These books provide the knowledge, strategies, and mindset needed to achieve financial independence and build wealth.

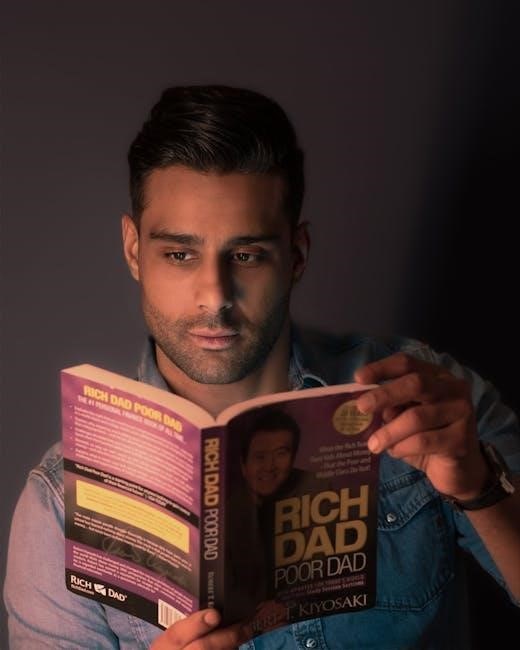

Rich Dad Poor Dad: Mindset and Financial Education

Robert Kiyosaki’s “Rich Dad Poor Dad” shatters the myth that a high income is necessary to become rich. It emphasizes the crucial difference between assets and liabilities, advocating for investing in assets that generate income. The book contrasts the mindsets of Kiyosaki’s two father figures: one with a traditional, security-focused approach, and the other with an entrepreneurial, wealth-building perspective.

“Rich Dad Poor Dad” is not about get rich quick schemes; it’s about financial literacy and long-term wealth creation. Kiyosaki stresses the importance of understanding financial statements, investing, and minimizing taxes. The book encourages readers to challenge conventional wisdom about money and to take control of their financial futures by adopting the mindset of the wealthy. It inspires readers to seek financial education, learn about cash flow, and build a solid foundation for wealth.

The Richest Man in Babylon: Timeless Financial Principles

George S. Clason’s “The Richest Man in Babylon” imparts timeless financial wisdom through captivating parables set in ancient Babylon. The book emphasizes fundamental principles such as “pay yourself first,” advising readers to save a portion of their income before spending. It stresses the importance of living within your means, avoiding debt, and seeking advice from knowledgeable sources.

The book advocates for investing wisely to generate passive income and ensuring the security of your principal. “The Richest Man in Babylon” highlights the value of continuous learning, hard work, and perseverance in achieving financial success. It encourages readers to embrace thriftiness, avoid impulsive decisions, and cultivate a long-term perspective on wealth accumulation. These ancient lessons remain highly relevant today.

The Millionaire Next Door: Understanding the Habits of the Wealthy

Thomas J. Stanley and William D. Danko’s “The Millionaire Next Door” offers a compelling analysis of how ordinary individuals accumulate wealth. The authors debunk common misconceptions about millionaires, revealing that most are not flashy spenders but rather frugal and disciplined savers. The book emphasizes the importance of living below one’s means, avoiding conspicuous consumption, and prioritizing financial independence over social status.

It highlights that many millionaires achieve their wealth through hard work, consistent saving, and strategic investing. “The Millionaire Next Door” provides valuable insights into the habits, attitudes, and lifestyles of the wealthy, offering a practical roadmap for anyone seeking to build their own fortune through financial prudence and long-term planning.

Mindset and Psychology of Wealth

Cultivating a wealth-oriented mindset is crucial for financial success. Explore the psychological factors influencing financial decisions and learn how to adopt the thinking patterns of wealthy individuals to achieve prosperity.

How Rich People Think: Adopting a Wealth-Oriented Mindset

Understanding the mindset of the wealthy is paramount to achieving financial success. Books like “How Rich People Think” by Steve Siebold delve into the contrasting philosophies between the middle class and the world class regarding wealth. The core strategy involves learning, emulating, and acting upon the thought patterns of the rich.

These books highlight that mastering simple concepts, such as prioritizing self-payment and living within means, can lead to significant financial gains. By adopting a wealth-oriented mindset, individuals can transform their approach to money and unlock their potential for building substantial wealth. This involves cultivating discipline, embracing calculated risks, and maintaining a long-term perspective on investments and financial planning. This shift in thinking is often the first and most critical step toward lasting prosperity.

The Psychology of Money: Emotional Intelligence in Financial Decisions

Financial decisions are often driven by emotion rather than logic, making emotional intelligence crucial for building wealth. Books like “The Psychology of Money” by Morgan Housel emphasize the importance of understanding how emotions impact financial choices. This involves recognizing and managing biases that can lead to poor investment decisions and financial instability;

Learning to separate emotions from financial planning allows for more rational and strategic decision-making. Developing emotional intelligence in finance includes practicing patience, avoiding impulsive reactions to market fluctuations, and understanding personal risk tolerance. By mastering the psychological aspects of money, individuals can create a more stable and prosperous financial future. This involves cultivating a long-term perspective and avoiding short-term emotional traps.

Actionable Strategies and Habits

Transform your financial life by implementing key concepts and developing rich habits. Learn daily practices for success, focusing on actionable strategies that pave the path toward wealth accumulation and financial independence.

Implementing Key Concepts: Paying Yourself First and Living Within Your Means

Mastering fundamental financial concepts is crucial for building wealth. Prioritize paying yourself first, setting aside a portion of your income for savings and investments before covering expenses. This principle, emphasized in classics like “The Richest Man in Babylon,” forms the bedrock of financial security. Complement this habit by diligently living within your means, ensuring expenditures remain lower than income to create a surplus for wealth-building activities.

Avoid lifestyle inflation as your income grows, and consciously make spending choices that align with your financial goals. Cultivating these disciplines creates a solid foundation for long-term financial success, enabling you to accumulate assets and achieve financial independence.

Developing Rich Habits: Daily Practices for Success

Cultivating daily habits aligned with wealth creation is essential for long-term financial success. Start by diligently tracking your income and expenses to gain a clear understanding of your financial flows. Dedicate time each day to learning about investing, personal finance, or entrepreneurship, expanding your knowledge base. Network with like-minded individuals, seeking mentorship and collaboration opportunities.

Consistently save a portion of your income, automating the process to ensure regular contributions to your investment accounts. Practice gratitude, fostering a positive mindset that attracts abundance. Review your financial goals daily, reinforcing your commitment to achieving financial independence. By incorporating these rich habits into your daily routine, you’ll pave the way for lasting prosperity.

Entrepreneurship and Investing

Explore the dual paths to wealth creation: entrepreneurship and strategic investing. Discover how launching a successful business and making intelligent investment choices can accelerate your journey to financial independence and lasting wealth.

The Millionaire Fastlane: Building Wealth Through Entrepreneurship

MJ DeMarco’s “The Millionaire Fastlane” presents an alternative to the traditional slow-lane approach to wealth building. The book challenges conventional wisdom, advocating for entrepreneurship as the fastest route to financial freedom. It emphasizes creating businesses that offer significant value and generate passive income.

DeMarco encourages readers to break free from the constraints of a 9-to-5 job and embrace the entrepreneurial mindset. The core of the fastlane philosophy involves building systems and businesses that operate independently of your time, allowing for exponential growth. By understanding and applying the principles outlined in the book, aspiring entrepreneurs can accelerate their journey to wealth.

The book provides a unique perspective on building wealth quickly through entrepreneurship.

Intelligent Investor: Value Investing Strategies

Benjamin Graham’s “The Intelligent Investor” is a cornerstone of value investing. This seminal work provides a framework for making informed investment decisions based on thorough analysis and a long-term perspective. Graham advocates for buying undervalued assets, focusing on the intrinsic value of companies rather than speculative market trends.

The book emphasizes the importance of a margin of safety, protecting investments from market fluctuations and errors in judgment. “The Intelligent Investor” guides readers on how to analyze financial statements, assess company performance, and identify opportunities where the market price deviates from the true value.

It is essential reading for anyone seeking to build wealth through prudent and disciplined investing. By following Graham’s principles, investors can navigate the market with confidence and achieve long-term financial success.